Kadar caruman bagi majikan dan pekerja terkini yang berkuat kuasa mulai gaji upah januari 2021 boleh. Employees Provident Fund Amendment Act 2019.

Pin On Epf Kwap Ltat Lth Pnb Ptptn

E-Voluntary Excess e-VE More Info.

. The memo states - Government of lndia will pay the full employers contribution EPF and EPS both wef. Besides the EPF employers had to contribute 833 on the pension for every individual employee. B 1582020 Sections 6 8 and 11 of the Act comes into operation on 1-10-2020 PU.

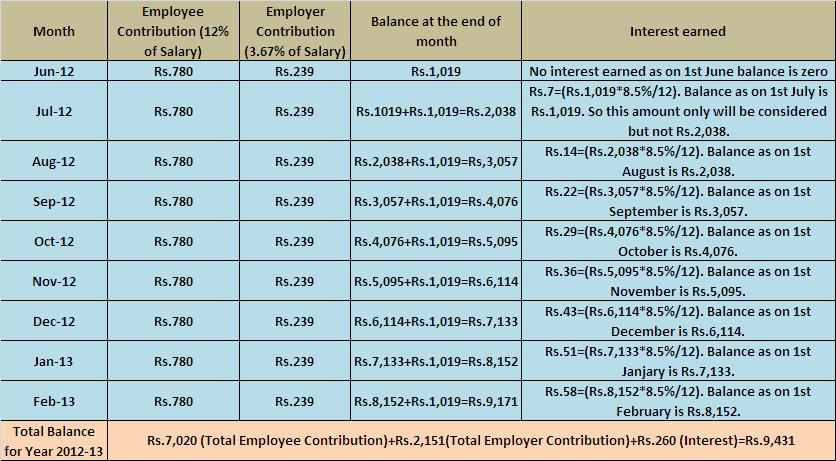

Assuming the employee joined service on 1st April 2021 contributions start for the financial year 2021 2022 from April. Updated PCB calculator for YA2019. However new Indian Budget for 2015 was released bringing relief to some.

The company will pay 175 while the staffworkers will contribute 05 of their wages for the Employment Injury Insurance Scheme and the Invalidity Pension Scheme. Hendaklah dikira pada 11 daripada amaun upah bagi bulan itu dan kadar. Contribution to be paid on up to maximum wage ceiling of 15000- even if PF is paid on higher wages.

1-4-2020 until 31-12-2020. Assessment of Contribution. Introduced PCB Schedule Mode where PCB amount will match LHDN PCB Schedule.

Is important to stay updated with the latest epf interest rates. 65 of the employees salary. Example for each employee getting wages above 15000 amount will be 75- 3.

Total EPF Contribution for April 2350. Removed YA2017 tax comparison. Contribution By Employer Only.

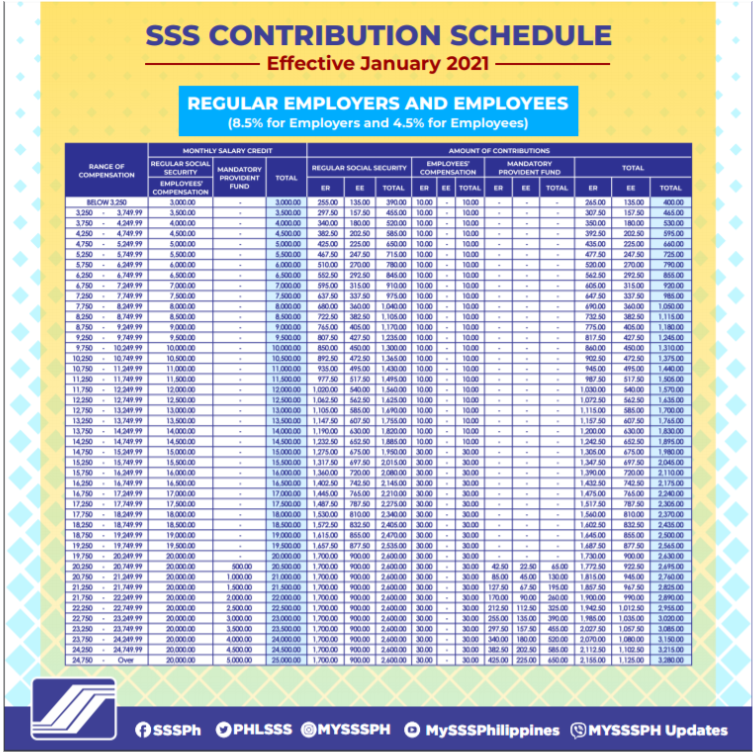

01042018 for a period of three years to the new employees and existing beneficiaries for their remaining period of three years through EPFO. Contribution schedule for regular social security. Contribution Amount Employer Additional Contribution Amount Member Additional Contribution Amount Total Contribution Amount Monthly Gross Salary Employment 1 Active 2 On-Leave 3 Terminated Employment.

EDLI contribution to be paid even if member has crossed 58 years age and pension contribution is not payable. RATE OF CONTRIBUTION FOR THE MONTH By the By the Total Employer Employee Contribution RM RM RM RM RM From 12001 to 14000 1900 1300 3200 From 14001 to 16000 2100 1500 3600 From 16001 to 18000 2400 1700 4100 From 18001 to 20000 2600 1800 4400 From 20001 to 22000 2900 2000 4900. When calculating interest the interest applicable per month is 81012 0675.

Now assuming that the employee joined the organization on 1 April 2019 his contributions to his EPF account would be calculated from the financial year 2019 2020. When wages exceed RM30 but not RM50. The contribution rate of epf 11 percent epf socso way last content caruman kwsp 2019 schedule caruman kwsp 2020 11 peratus download timeline trãªs caruman.

Employee EPF contribution has been adjusted to follow EPF Third Schedule. The terminal date of registration of beneficiary though an establishment is 31st March 2019. RATE OF CONTRIBUTION FOR THE MONTH By the By the Total Employer Employee Contribution RM RM RM RM RM From 8001 to 10000 1300 700 2000 From 10001 to 12000 1600 900 2500 From 12001 to 14000 1900 1000 2900 From 14001 to 16000 2100 1200 3300 From 16001 to 18000 2400 1300 3700.

Additional monthly contributions ranging from 265 to 850 will all go to the members WISP account Provident Fund Additional monthly contributions range from 30 to 200 only. Total EPF contribution in the month of April Rs. EPF contribution of both employer and employee 12 percent each for the next three months so that nobody suffers due to loss of continuity in the EPFO contribution This is for those establishments that have up to 100 employees and 90 percent of whom earn under Rs 15000 monthly wage This will benefit about 80 Lakh employees.

Examples of Allowable Deduction are. Jadual PCB 2020 PCB Table 2018. Wages up to RM30.

Employees provident fund act 1991. TDS should be at the average rate of tax. The Employees Contribution Rate Reverts to 11 More Info.

EPF contributions tax relief up to RM4000 this is already taken into consideration by the salary calculator Life insurance premiums and takaful relief up to RM3000. EPF Contribution Third Schedule. More ways to get in touch.

EPF tax relief limit revised to RM4000 per year. Instalment Plan More Info. Employees Provident Fund Amendment of Third Schedule Order 2020.

72 Where any contribution made by an employer including interest on such contributions if any in an approved Superannuation Fund is paid to the employee tax on the amount so paid shall be deducted by the trustees of the Fund to the extent provided in Rule 6 of Part B of the Fourth Schedule to the Act. 2350Interest on EPF for the month of April NIL since no interest is offered on the first month of contribution to EPFEPF account balance at. A company is required to contribute SOCSO for its staffworkers according to the SOCSO Contribution Table Rates as determined by the Act.

The EPF receives and manages retirement savings for all its members encompassing mandatory contributions by employees of the private and non-pensionable public sectors as well as voluntary contributions by those in the informal sector. When wages exceed RM50 but not RM70. 03 8922 6222.

I-Invest Portal Survey Click Here. Both the rates of contribution are based on the total. Earlier the EPF functioned based on contributing 12 of their monthly salary towards EPF while the employer too had to make the same contribution every month.

03 8922 6000. 2021 CONTRIBUTION SCHEDULE 1 2 3 Additional monthly amount ranges from 10 to 100 only for combined employee and employer shares. SIP EIS Table.

When wages exceed RM70 but not RM100. 15-03-2020 except sections 6 8 and 11 of the Act PU. For employees who receive wagessalary of rm5000 and below the portion of employees contribution is 11 of their monthly salary while the employer.

INFO EPF ENHANCES i-INVEST PORTAL WITH NEW FEATURES TO HELP MEMBERS MAKE INFORMED DECISIONS 16 APR. Mon Fri 800AM to 600PM. Each contribution is to be rounded to nearest rupee.

MOBILE TEAM NEAR YOU.

Kwsp Epf Sets Rm228 000 As Minimum Target Savings At Age 55

New Sss Contribution Table 2019 With Computations Pinoymoneytalk Com Contribution Sss Employment Agency

8 Mac 2021 Commercial Marketing D I D

Epf Kwsp Dividend Rates 2019 Otosection

Sss Contribution Table 2022 Sss Membership Benefits

2019 Epf Updates Include Decreasing Senior Staff Contribution To 4

Download Employee Provident Fund Calculator Excel Template Exceldatapro

Epf Employees Provident Fund Contribution Calculation Otosection

Socso Table 2019 For Payroll Malaysia Smart Touch Technology

How Epf Employees Provident Fund Interest Is Calculated

Download Employee Provident Fund Calculator Excel Template Exceldatapro

How To Calculate Your Sss Contribution Sprout Solutions

Ppf 2019 Public Provident Fund Debt Investment Investing

30 Nov 2020 Bar Chart Chart 10 Things

Mandatory Seeding Of Aadhaar Number With Uan Till 30 11 2021 Employment Government Organisation